The Corporate Transparency Act (CTA), implemented by the U.S. Department of the Treasury, Financial Crimes Enforcement Network (FinCEN), is a new law that requires U.S. businesses and other companies doing business in the U.S. to complete a Beneficial Ownership Information (BOI) Report. The BOI report includes information about businesses and the individuals who own or control them.

FinCEN began accepting reports on January 1, 2024.

What is the Purpose of the Corporate Transparency Act?

The Corporate Transparency Act aims to prevent and combat money laundering, terrorist financing, corruption, and tax fraud by making it more difficult for criminals to create and exploit businesses with artificially complex and multi-layered ownership structures.

Reporting Requirements

Reporting companies subject to the CTA are required to provide certain information about the company such as the identities of the individuals who own or control the company. Reporting requirements are perpetual and filings with FinCEN must be updated within 30 days of any change. Below is an overview of the reporting requirements.

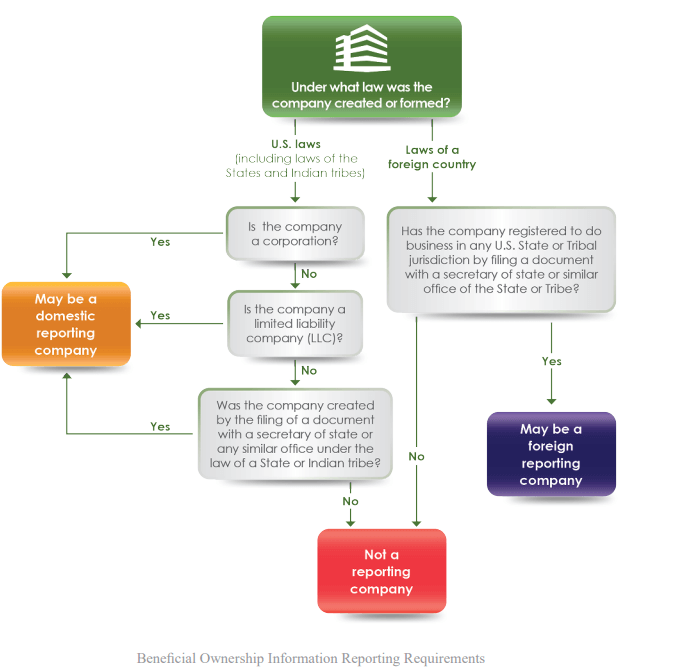

What Companies are Considered a ‘Reporting Company’ Under the CTA?

- Domestic companies

- Foreign companies doing business in the U.S.

Reporting companies must report the following:

- Legal company name and any trade name or DBA (doing business as)

- The physical address of the business

- Tax ID/EIN (employer identification number)

- Jurisdiction of Formation

Some businesses are exempt from the requirements of the CTA. Information regarding those exemptions is detailed below.

Who is Considered a ‘Beneficial Owner’ Under the CTA?

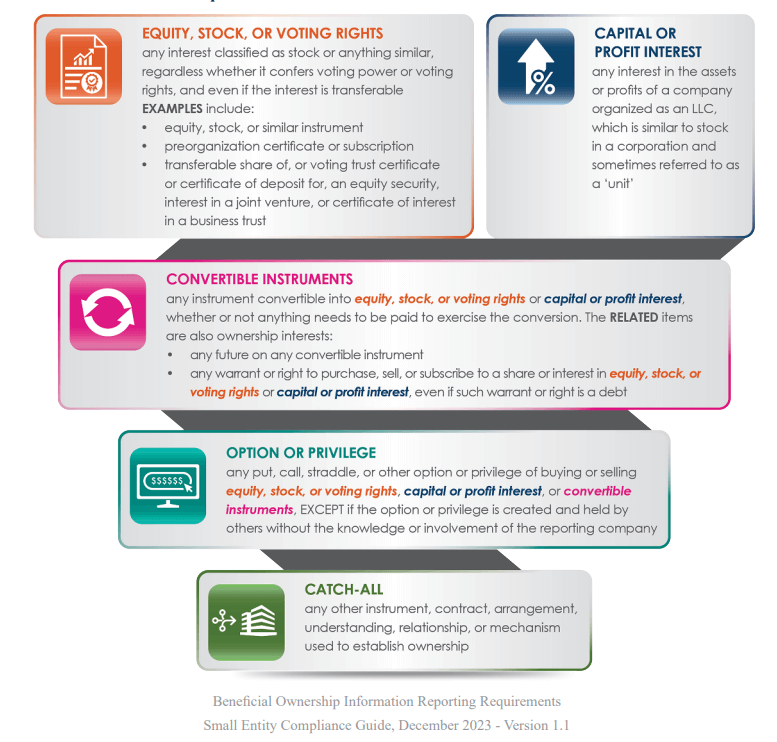

- Individuals who own at least 25% interest in the company

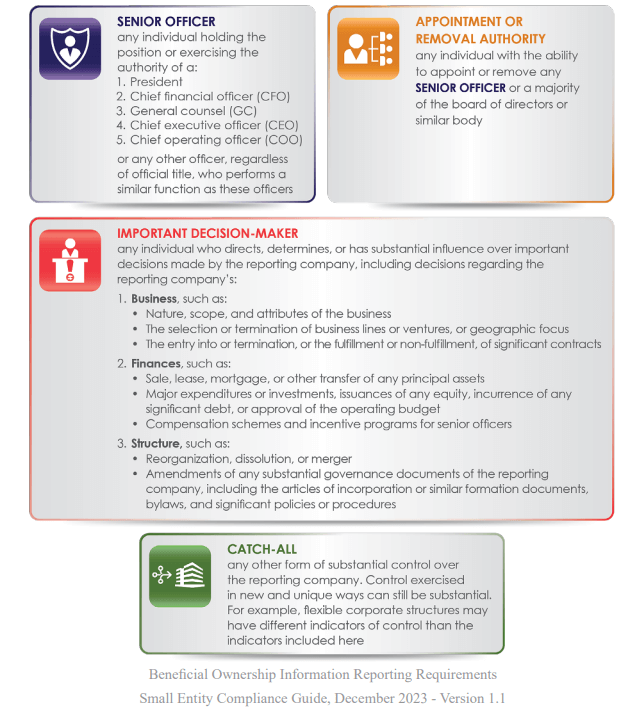

- Individuals who have “substantial control” over the company

The CTA sets forth a range of activities that could constitute substantial control.

Beneficial Owners must report the following:

- Full legal name

- Date of birth

- Current physical address

- Passport number, driver’s license number, etc. along with an uploaded photo of the document.

Who is Considered a ‘Company Applicant’ Under the CTA?

- The individual who directly files the document that creates the entity.

- The individual who is primarily responsible for directing or controlling the filing of the relevant document by another person, such as an attorney.

Company applicants must report the following:

- Full legal name

- Date of birth

- Current physical address

- Passport number, driver’s license number, etc. along with an uploaded photo of the document.

When Do I Need to File a BOI Report?

When the company is formed will determine the timeline requirements for filing a BOI report.

- For companies formed before Jan. 1, 2024: You must file a BOI report before Jan. 1, 2025.

- For companies formed on or after Jan. 1, 2024: You must file a BOI report within 90 days of formation.

- For companies formed on or after Jan. 1, 2025: You must file a BOI report within 30 days of formation.

If you have any changes to legal names, mailing addresses, or ownership interests, an updated report must be filed within 30 days of the changes.

Frequently Asked Questions

How do I file?

To file a BOI report, all you need to do is visit boiefiling.fincen.gov and follow the prompts. Click here to file a report.

What is a FinCEN ID?

A FinCEN ID is a unique identification number issued to an individual. Although there is no requirement to obtain a FinCEN ID, doing so can simplify the reporting process. An individual business owner or company applicant’s FinCEN ID can be reported instead of the required information about the individual, like a frequent flyer number for airlines.

Is there an annual reporting requirement?

No. However, you have only 30 days to file an updated report if anyone who was previously listed as a beneficial owner or company applicant changes their legal name or mailing address. Revised documents with proof of the change must also be uploaded, i.e., a photo of a new driver’s license or passport.

Is there a cost for filing a BOI report?

No. Filing a report is free and can be done online.

What is the penalty for individuals who don’t file a report?

Any person who willfully violates BOI reporting requirements can be fined up to $500 for each day that the violation continues or up to two years imprisonment.

Is My Company Considered a ‘Reporting Company?’

All reporting companies must file BOI reports with FinCEN within the previously specified periods. A reporting company is any entity that meets the “reporting company” definition and does not qualify for an exemption. There are two categories of reporting companies: domestic and foreign.

If your company is neither a “domestic reporting company” nor a “foreign reporting company” because it does not meet either definition (as described in the graphic below), or it qualifies for an exemption, then you are not required to file a BOI report with FinCEN. Below are some guidelines from the FinCen Small Entity Compliance Guide.

Is my Company Exempt from Filing a BOI Report?

Below is a list of companies that are exempt from filing a report. These companies are exempt to prevent duplicate reporting burdens for entities that are already in compliance with federal regulations. Others are exempt to help the CTA’s reporting requirements focus on entities that are more susceptible to misuse for illicit activities.

- Securities reporting issuer

- Governmental authority

- Bank

- Credit union

- Depository institution holding company

- Money services business

- Broker or dealer in securities

- Securities exchange or clearing agency

- Other Exchange Act registered entity

- Investment company or investment adviser

- Venture capital fund adviser

- Insurance company

- State-licensed insurance producer

- Commodity Exchange Act registered entity

- Accounting firm

- Public utility

- Financial market utility

- Pooled investment vehicle

- Tax-exempt entity

- Entity assisting a tax-exempt entity

- Large operating company

- 20+ employees & $5 million revenue

- Subsidiary of certain exempt entities

- Inactive entity

Who is the Beneficial Owner of a Company?

A Beneficial Owner is any individual who exercises substantial control or anyone who owns at least 25% of the ownership interests of a reporting company. Below are some guidelines to help you determine who is a Beneficial Owner. Below are some guidelines from the FinCen Small Entity Compliance Guide.

Ownership Interests

Who is a ‘Company Applicant’ at my Company?

Reporting companies are required to report at least one, and at most, two individuals.

- Direct Filer

This person is always required to report, and they are the individual who directly, physically, or electronically filed the document that created the reporting company (i.e. an attorney or paralegal).

- Directs or Controls the Filing Action

This is the individual who is primarily responsible for directing or controlling the filing (i.e. a business owner or employee of the company).

Click here for more information.

Click here for the BOI Small Compliance Guide